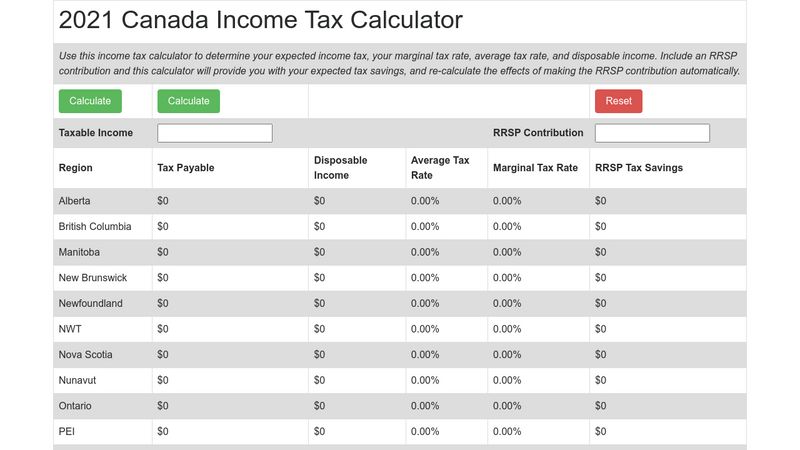

income tax calculator canada

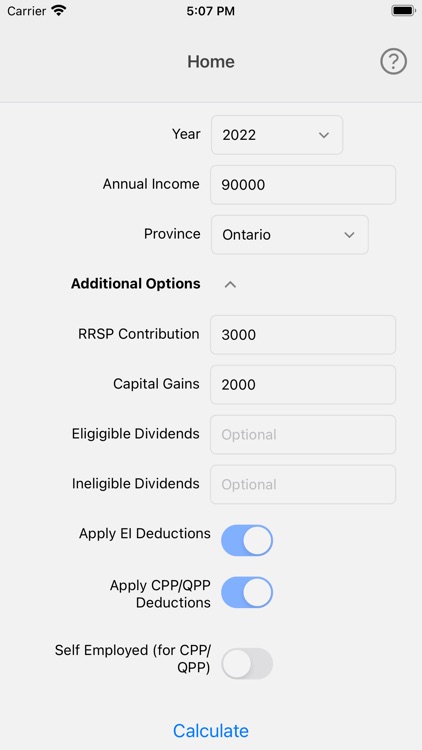

To help you estimate your income tax in Canada weve compiled a table with the 2022 federal tax rates. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time.

Canada Income Tax Calculator R Personalfinancecanada

Federal tax which is the money youre paying to the Canadian government.

. Calculate the tax savings. Federal tax rates range from 15 to 33 depending on your income while. Simply click on the year and enter your taxable income.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. If you have income from sources other than employment use our tax calculator. Canadian Tax Calculator 2022.

Canada income tax calculator. Find out your tax brackets and how much Federal and Provincial. Personal tax calculator.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. You can also explore Canadian federal tax brackets provincial tax. Find out your federal taxes provincial taxes and your 2021 income tax refund.

Speak with a Perch mortgage advisor today. You can also explore Canadian federal tax brackets provincial tax. Use our free 2022 Canada income tax calculator to see how much you will pay in taxes.

2022 Canada Income Tax Calculator. 2022 Canada Income Tax Calculator. Your average tax rate is.

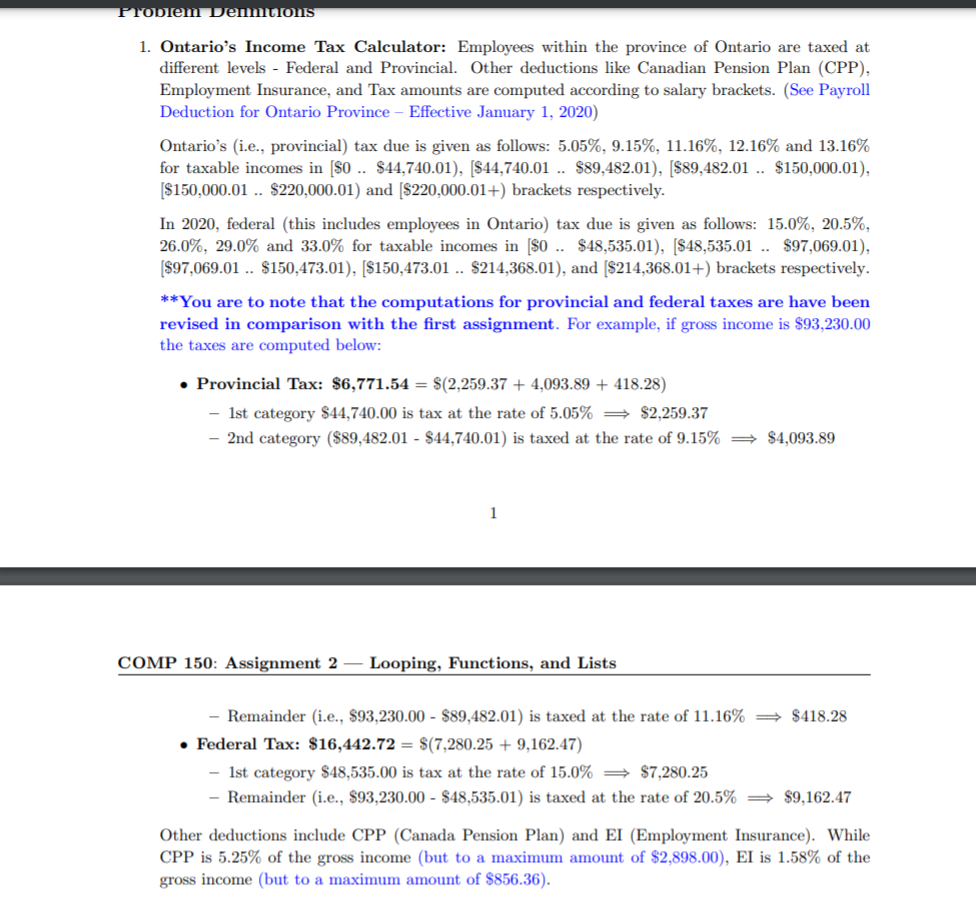

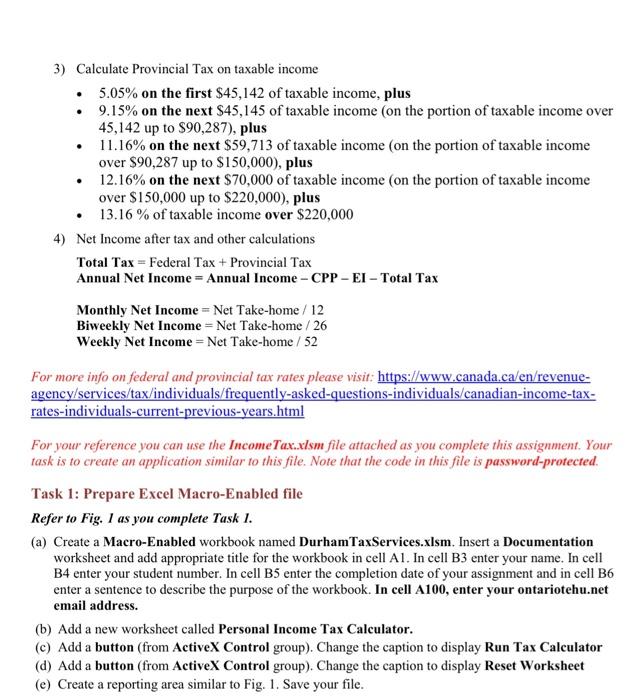

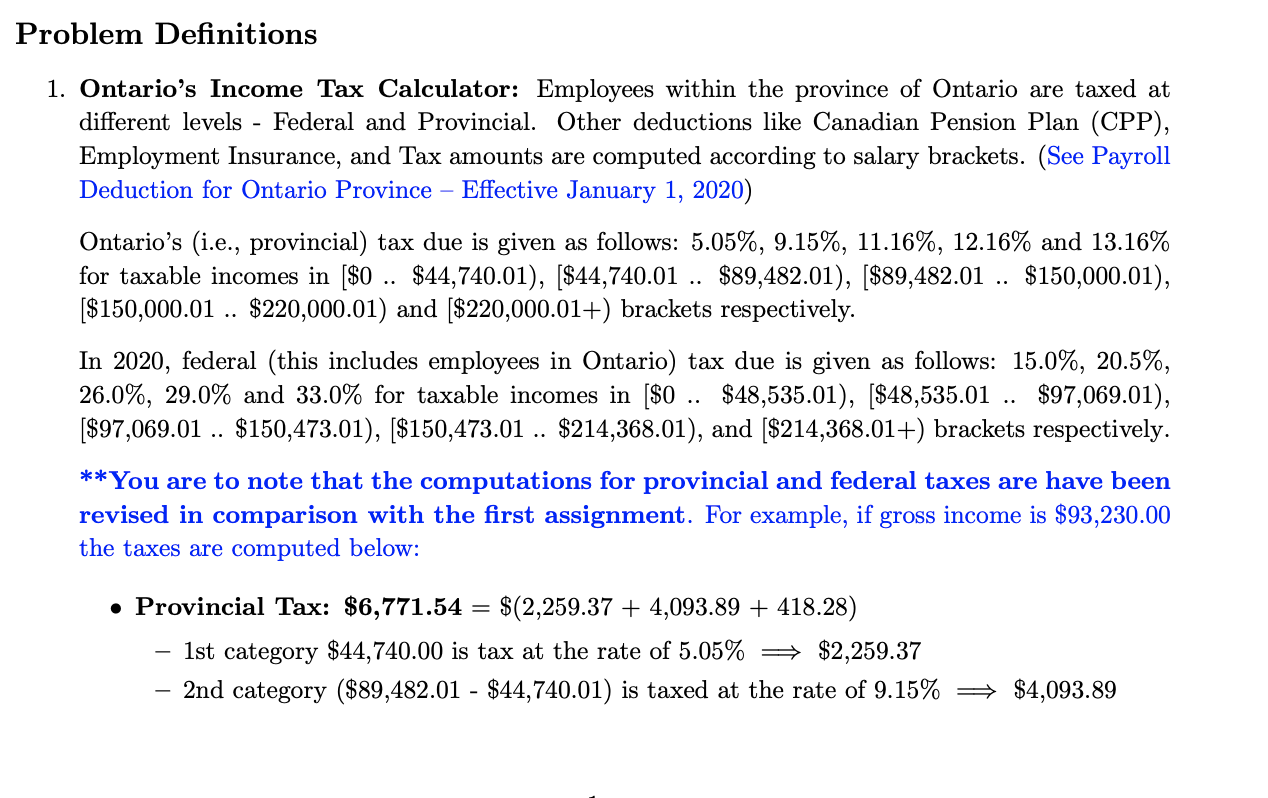

The tax rates for Ontario in 2022 are as follows. Earnings 150000 up to 220000 the rates are 1216. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces.

You can even factor in any CERB benefits received. Income Tax Calculator Canada. That means that your net pay will be 37957 per year or 3163 per month.

Since self-employed income capital gains eligible and non-eligible dividends. Get a free estimate your tax refund or amount owing with our Canadian tax return calculator. Get the best mortgage rate.

The Canada Annual Tax Calculator is updated for the 202223 tax year. 2023 Federal Income Tax Bracket s and Rates. Calculate your combined federal and provincial tax bill in each province and territory.

As a progressive tax system your income determines. Tax Rates in Canada for 2022. The personal income tax rate in Canada is progressive and assessed both on the federal level and the provincial level.

Fill in gross income and hours per. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. Use our simple 2021 income tax calculator.

2021 2022 tax brackets and most tax. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Canada income tax calculator.

Our salary calculator for Canada takes each of the four major tax expenses into account. Finally earnings above 220000 will be taxed at a rate of 1316. Use our free 2022 Canada income tax calculator to see how much you will pay in taxes.

Income Tax Calculator Canada is an online tool that can help you Calculate Salary After Tax Canada. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

Canada Income Tax Calculator Apk For Android Download

Canada Income Tax Calculator 2019 Tax Calculator Results Now

Solved Problem Demitons 1 Ontario S Income Tax Calculator Chegg Com

Salary Calculator Canada Salary After Tax

Income Tax Calculator Canada Calculate Salary After Tax Canada

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Solved Personal Income Tax Calculator Data File Needed For Chegg Com

Income Tax Formula Excel University

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Solved Create A Code In Python 3 Using The Following Chegg Com

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

Canada Income Tax Calculator By David Xu

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Gst Calculator Goods And Services Tax Calculation

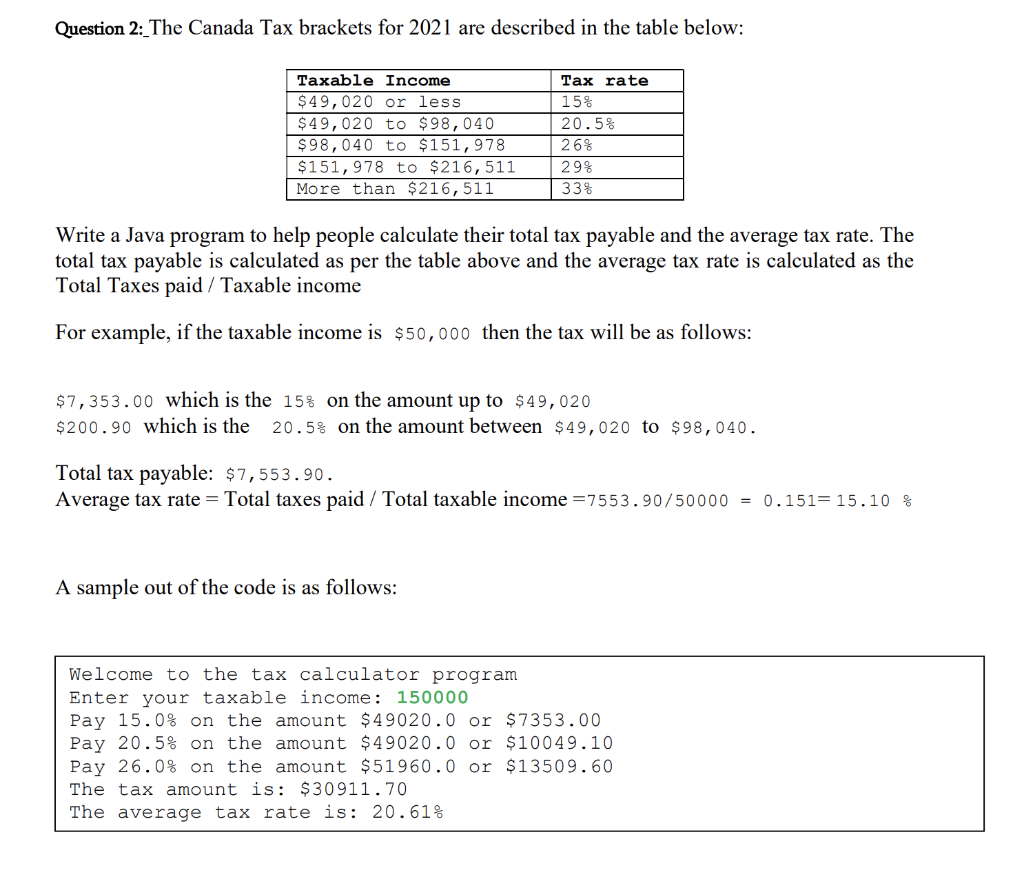

Solved Question 2 The Canada Tax Brackets For 2021 Are Chegg Com

![]()

Income Tax Calculator 2022 Canada Salary After Tax

122 Canadian Tax Return Stock Photos Free Royalty Free Stock Photos From Dreamstime